20+ assuming a mortgage

More Veterans Than Ever are Buying with 0 Down. Find out if the loan is assumable.

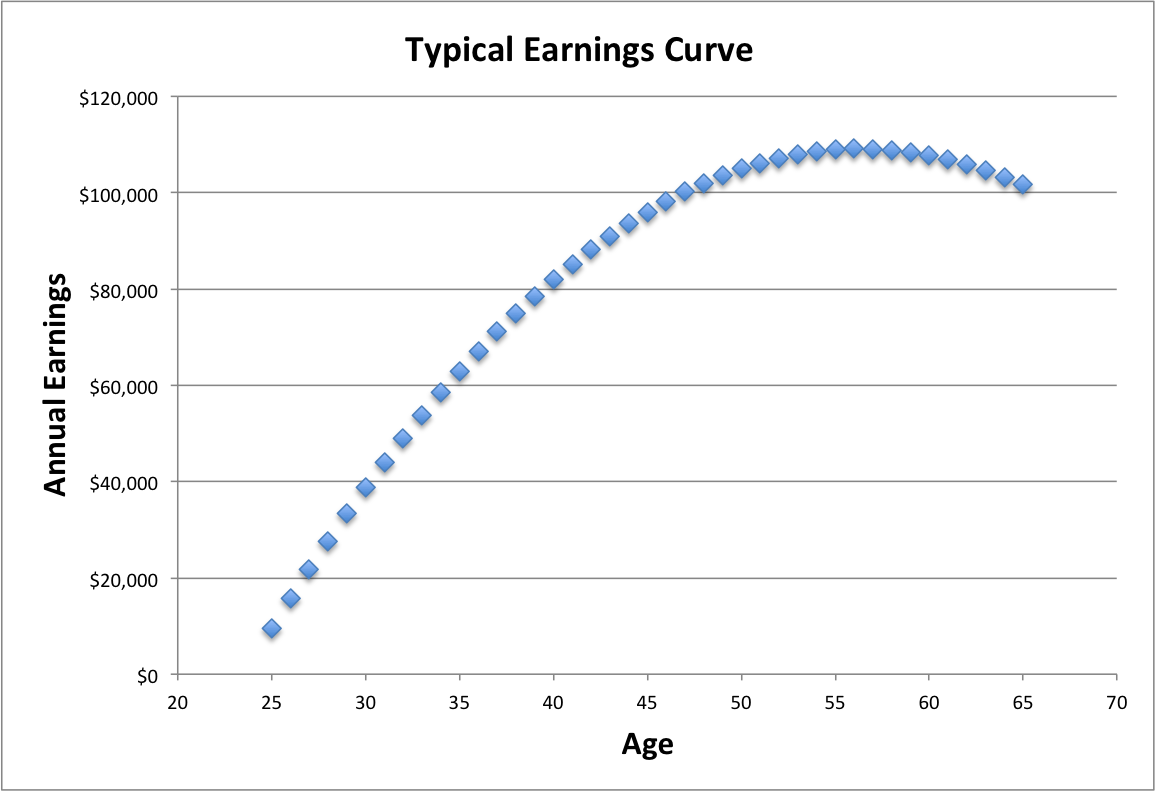

Recommended Net Worth Allocation By Age And Work Experience

Web Assumable mortgages also may have an assumption fee but not to worry that amount is capped for both FHA 900 and VA 5 of the loan loans.

. In this guide well cover everything you need to. Web Assumable Mortgage. Web Pros and cons of assumable mortgages Pros.

Once this loan is assumed the loan must be up to date. Assumable mortgages allow you to buy a house by taking over assuming the sellers mortgage rather than getting a new. Web A big drawback to assuming a mortgage is the cash youll have to pay the seller for their equity.

2 min read Jul 20 2022. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Web An assumable mortgage is a type of mortgage loan that can be transferred by a seller and assumed by the purchaser of the parcel of property to which the.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Instant Download and Complete your Mortgage Assumption Agreement Forms Start Now. In addition the buyer and the VA must meet all.

4 min read May 04 2022. 300 and a 05 funding fee paid by either the buyer. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

The Leading Online Publisher of National and State-specific Real Estate Legal Documents. Estimate Your Monthly Payment Today. Web An assumption is the term used by mortgage lenders to describe the process of taking over or assuming legal liability on a mortgage.

Make sure the property and buyer. Web Generally loans made during the last 20 years of a mortgage are rarely assumable with the notable exception of VA and FHA loans. Web An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower.

An assumable mortgage is a type of financing arrangement in which an outstanding mortgage and its terms can be transferred from the. Web If you want to assume the VA Loan you must have a current one. Web How to assume a mortgage when buying a house.

Not all loans are assumable. Mortgages What to know about mortgage prequalification. Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly.

Web The maximum allowable fees for FHA and VA loan assumptions are listed below. A steady income a small amount of debt compared to your income and a significant down. Click Play to Learn All.

If the homes purchase price was 300000 and the remaining. Web Here are the steps involved with the mortgage assumption process. Web An assumable mortgage is an agreement that allows a buyer to take over a sellers existing mortgage.

Typically this entails a home buyer taking over.

How To Assume A Mortgage 10 Steps With Pictures Wikihow

Integer Advisors

On The Relationship Between Spy And Hfea Returns R Hfea

High Probability Trading Strategies Entry To Exit Tactics For The Forex Futures And Stock Markets Wiley Trading Series Band 328 Miner Amazon De Bucher

What Are The Pros And Cons Of Pre Closing A Home Loan Quora

Assumable Stock Photos Free Royalty Free Stock Photos From Dreamstime

Mortgage Women Magazine 2022 Issue 2 By Ambizmedia Issuu

How Much Home Loan I Will Get On An Income Of 20000 Per Month Quora

Should I Buy A Home With Cash Or A Loan Quora

:max_bytes(150000):strip_icc()/parents-take-a-break-on-sofa-with-son-on-moving-day-635900900-5adc9ec46bf0690037a5955e.jpg)

Assumable Mortgage What Is It

Why Are Saving Rates Of Urban Households In China Rising In Imf Working Papers Volume 2008 Issue 145 2008

Retiring Early Lost Savings Seeking Alpha

How To Assume A Mortgage 10 Steps With Pictures Wikihow

Basel Ii Capital For Mortgage Portfolio By Segmentation Schemes And Lgd Download Table

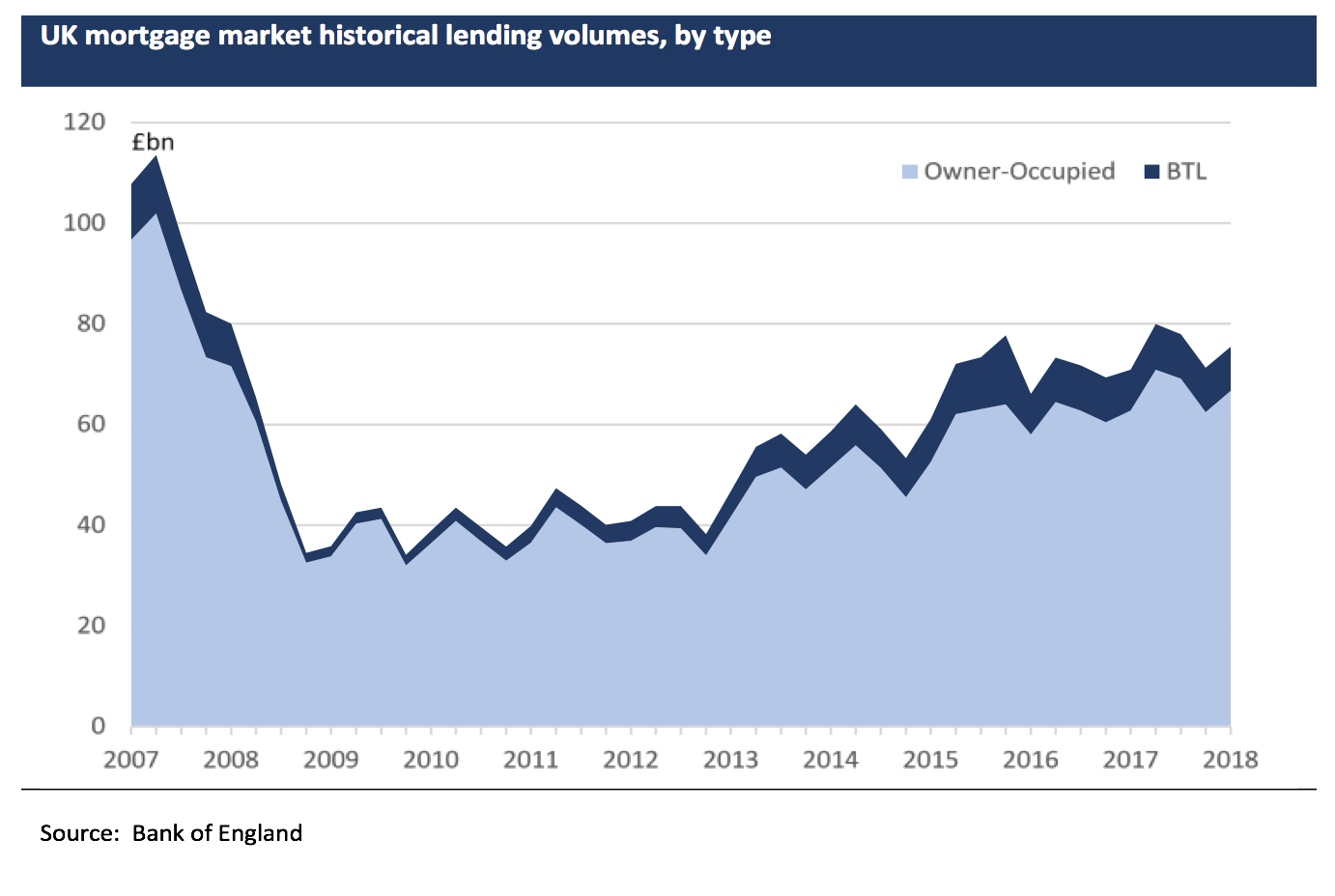

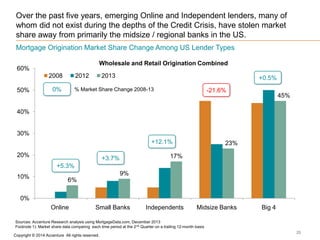

North America Mortgage Banking 2020 Convergent Disruption In The Cre

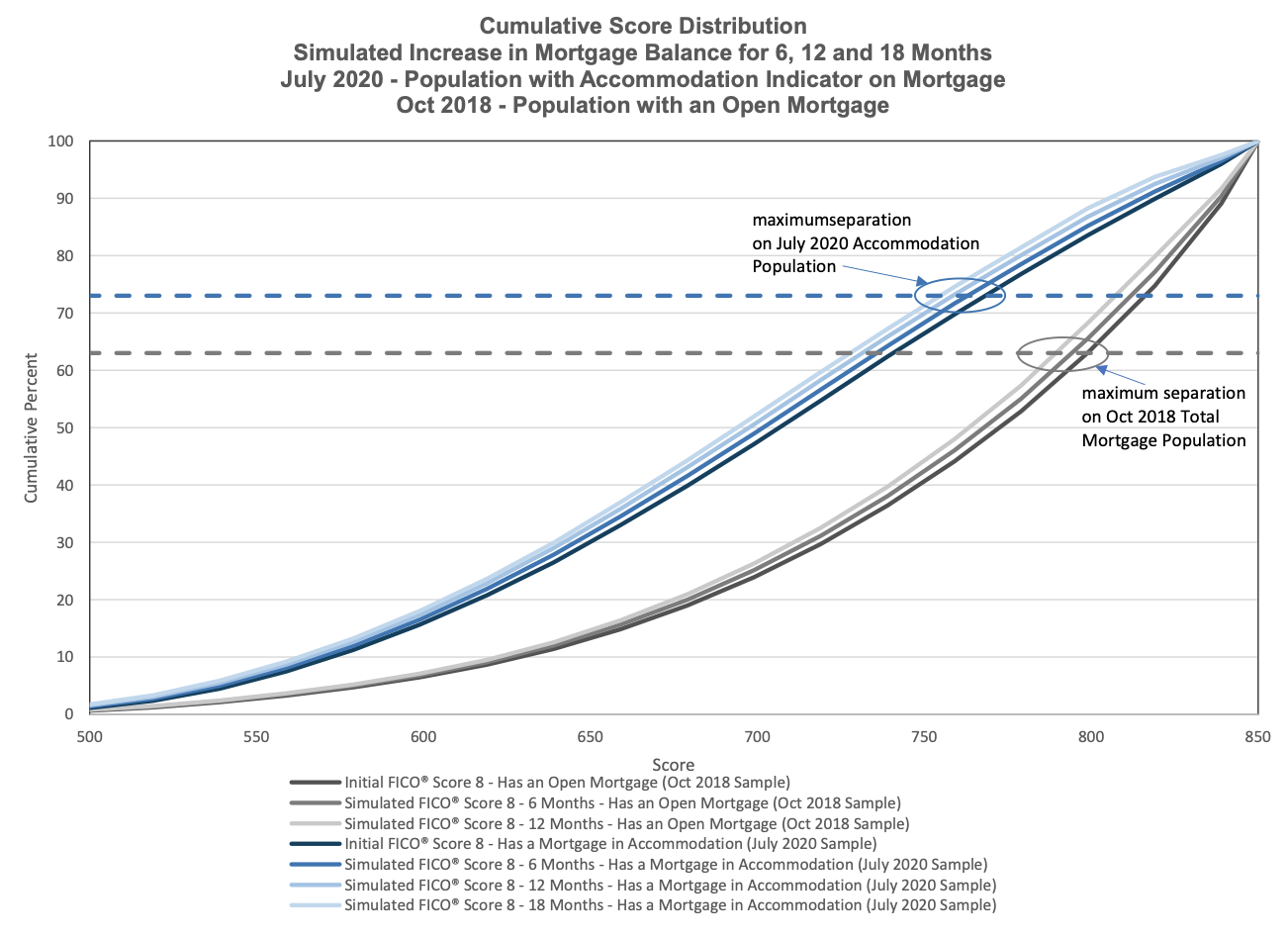

Simulated Fico Score Impacts From Balance Aggregation Due To Mortgage Forbearance

Ex 99 1